Head Office- Canada

2680 Skymark Avenue, Suite 700, Mississauga, Ontario L4W 5L6

US Office

2600 Virginia Ave NW, Suite B200, Washington, D.C. 20037

We provide brands with the tools they need to create customized reward experiences for clients, staff and corporate partners.

The Tru difference

Why brands love Tru

We don’t believe one size fits all solutions

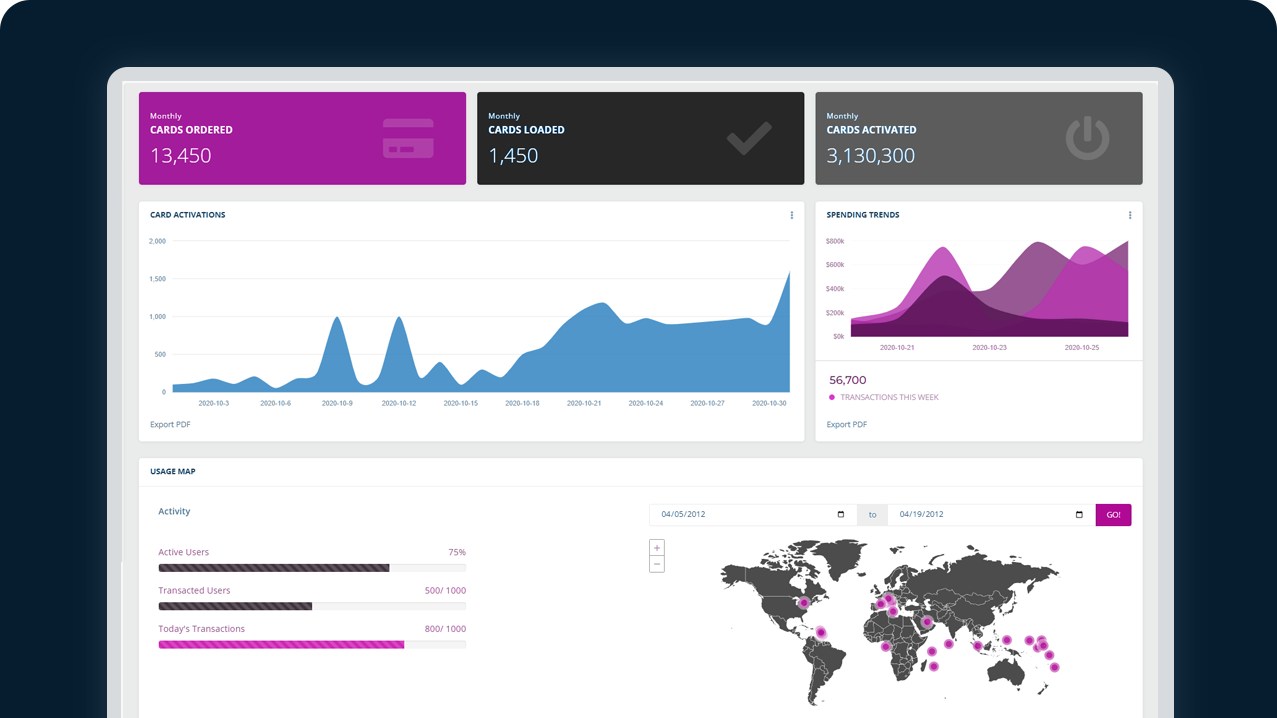

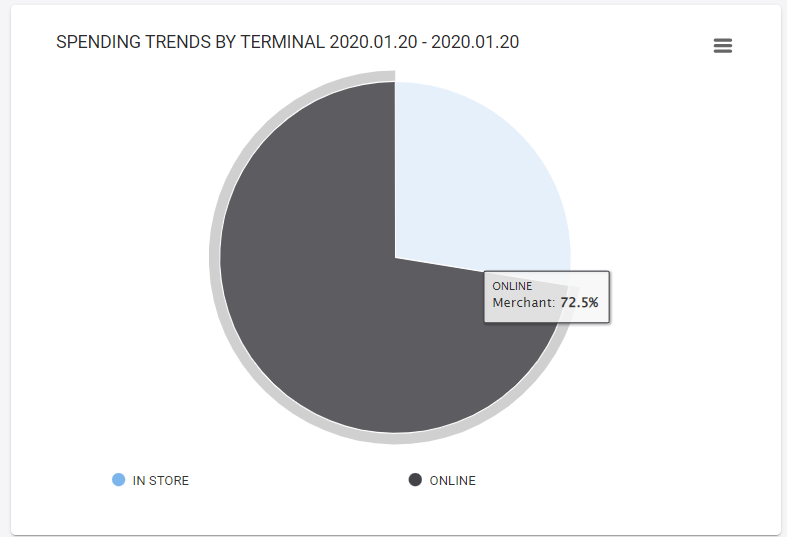

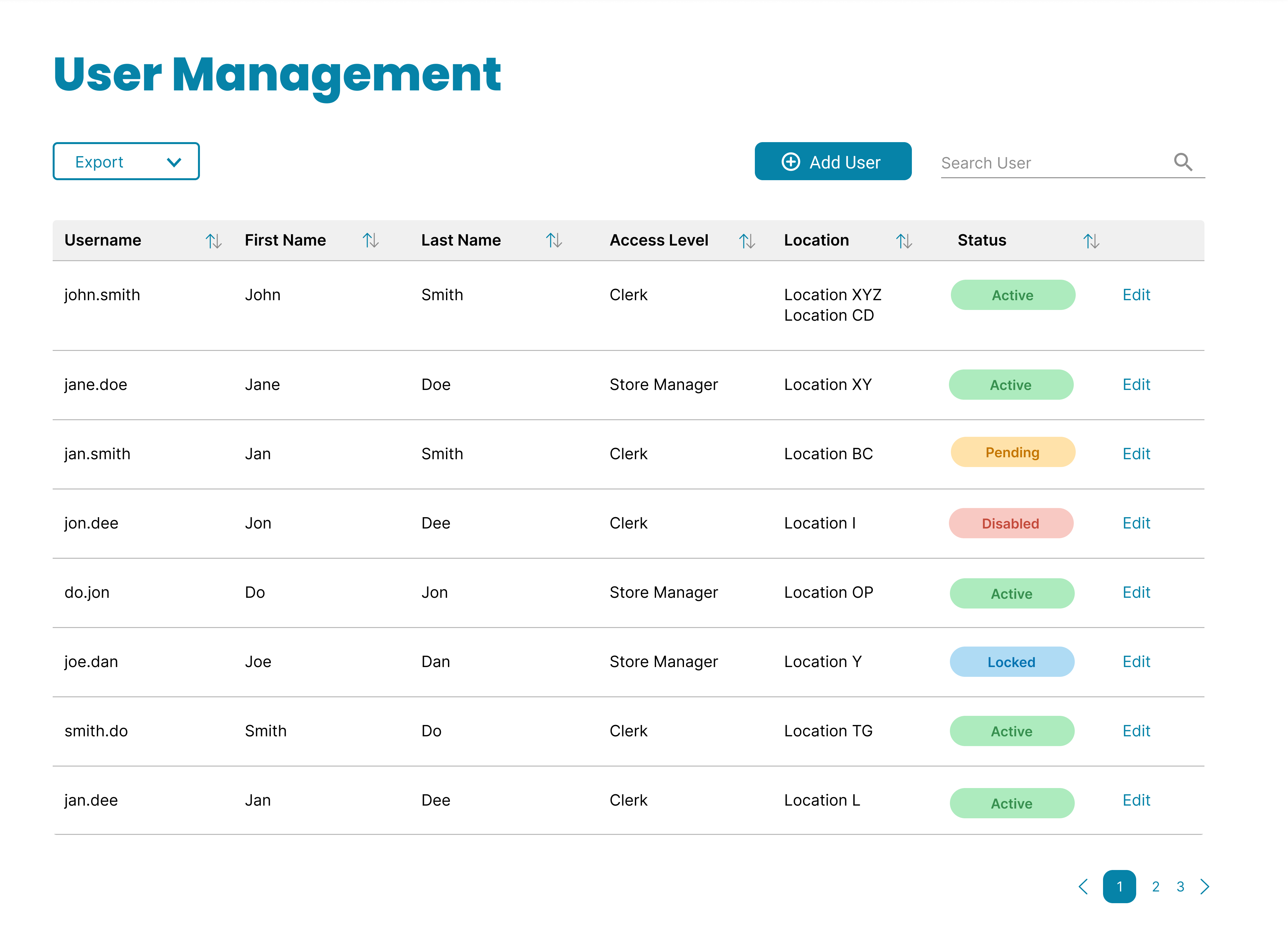

Gain deep user insights

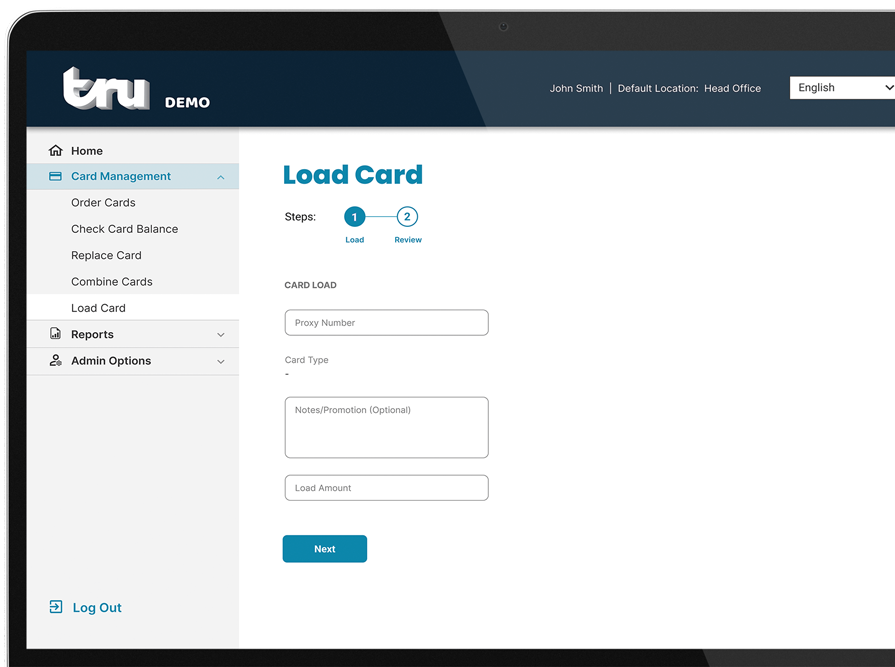

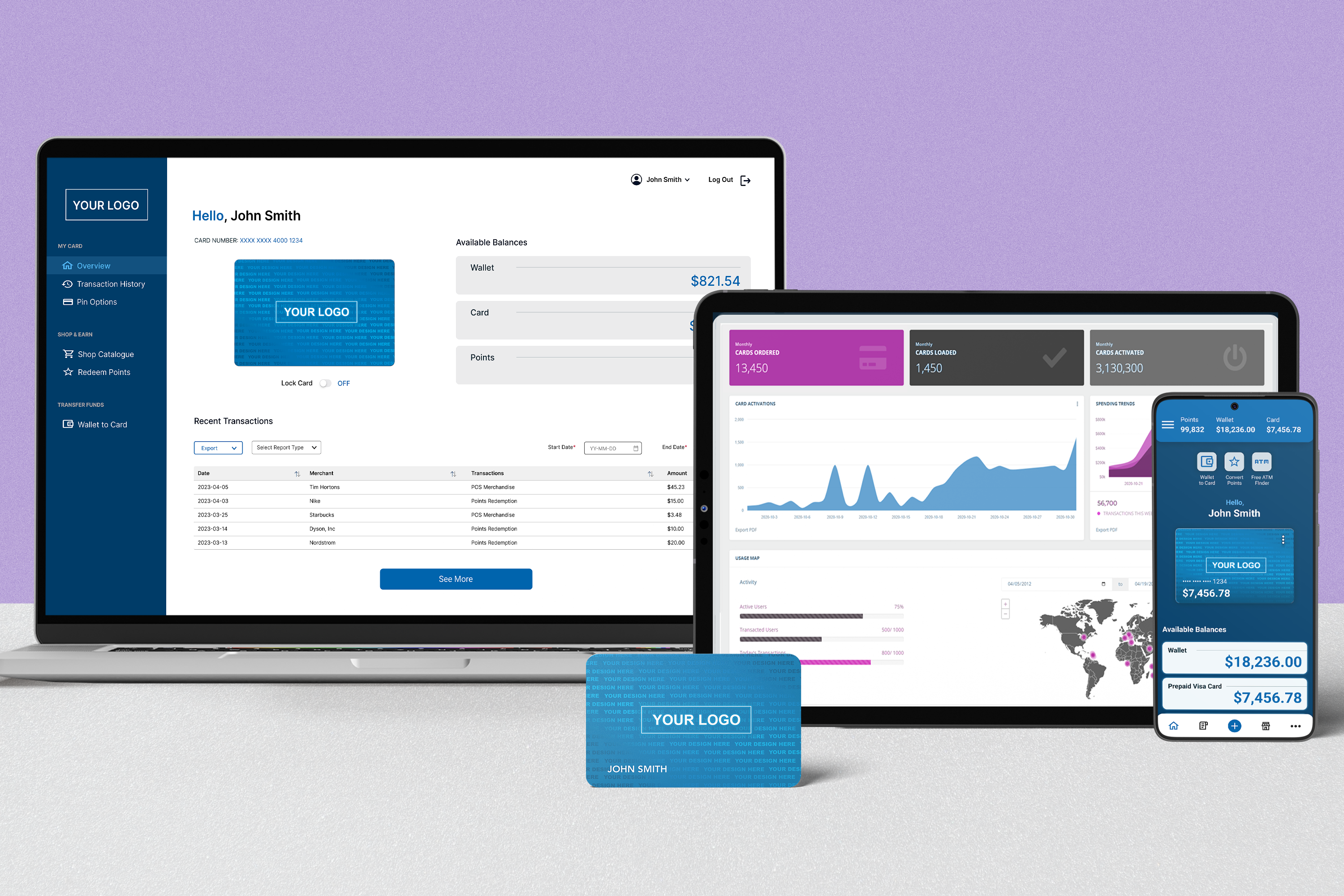

Create branded cardholder portals, custom user flows, apps and more. Offer immediate and secure access to funds available via web, mobile, POS or ATM.

Create mobile experiences

Open your program to the world

Gain deep user insights

Modular card platform

Give up on slow, generic & cumbersome incentives and payments

Offer easy-to-implement, personalized experiences, custom tailored to your needs and emblazoned with your brand.

Have questions? Just ask!

Tru, is an Canadian-based, female-led Marketing company set on a mission to disrupt and innovate the worldwide payment ecosystem using our innovative bank-agnostic FinTech platform.

We re-imagine loyalty and payments combining 30+ years experience with the vast capabilities of our bank-agnostic FinTech platform.

The Tru Prepaid Card is not a credit card. It is a prepaid, stored value payment card. Once funds are deposited on your card, you can make purchases, in-store or online, for goods and services at millions of locations worldwide where Visa® is accepted, subject to our Partner Bank restrictions.

Our company aims to build smarter, best-in-class disbursement solutions using the latest in fintech technology designed to deliver more rewarding, user friendly-experiences, that impact both the well-being and daily lives of our clients and customers, all from a single source.

In 2001, our founders had the vision to enhance traditional rewards and loyalty—one that provided real-time gratification while helping businesses reduce inefficiencies and gain a clearer understanding of their clients.

Today, we work with a growing network of over 500 brands across different industries, helping them manage and disburse billions of dollars to over millions of cardholders worldwide.

Customizable Funds Access

Distribute cards that can be used anywhere Visa is accepted, including ATMs and retail outlets. Configure your program to allow or restrict access via geo-location or merchant categories.

Reloadable Payments

Reload cards up to a maximum balance of $5,500 at any given time. Add additional funds at any time, as needed in real-time.

Spend Restrictions

Merchant Category Code (MCC) and geo restrictions, allow purchases to be limited to specific merchant types based on each individual partner’s needs.

Virtual Card Option

With Virtual cards, recipients can instantly claim and use a virtual card online.

Cash-back

Offer cash-back offers at hundreds of eligible merchant locations, earn points on your card that convert to cash.

Mobile Access

Extend payment features and card management while gaining an extra added layer of security protection.